I have no idea how my stuff reads, or even if people find it useful. I spent a boatload of time researching the root to the fruit for signs of solidarity within the investing community before sinking the house into the markets ... again. Not much discussion comes from it but it is still ultimately useful to me and what I do.

The source of speculation is to either risk your own capital stock or to borrow money. Libor is the reference rate across the worls for large lending of new investment stock.

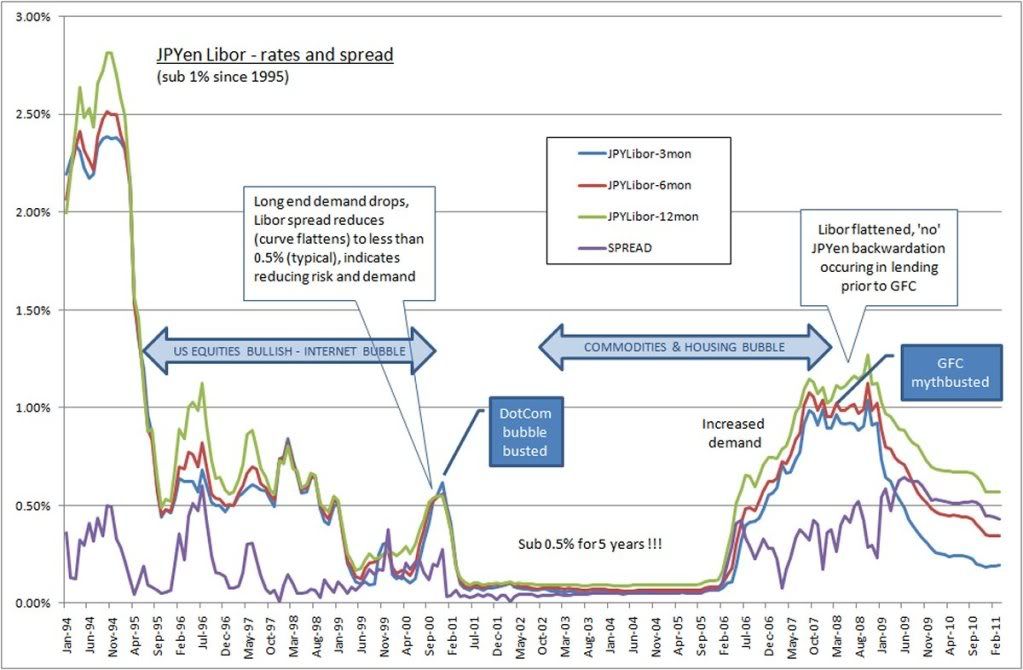

Looking at the Libor spreads is similar to analysing the Treasury yield spreads and yield curves. For instance, the Yen was recently used via the overnight, 1week, 2week and 1month lending facilities in the 15Mar2011 Yen/equity shock. Have a look at the Yen Libor for those periods - there was a large and sudden inrush of demand = speculation similar to the May2010 flashcrash. Repatriation has yet to really start, or has been squashed by speculation.

Some charts below - summary points first

0. Analysing Libor spreads is very similar but opposite in one key aspect to analysing Treasury yields. A drop in yields is an 'increase' in demand, rising competition for yields and falling comparable growth (seeking a reduction in risk). A drop in Libor shows a 'decrease' in demand, but a similar rising competition for lending against the background of falling opportunity for growth. Falling yields indicate a decrease in performance in the broader market - so 'can' falling Libor, but there is an obvious sinister twist that comes with zero rate lending.

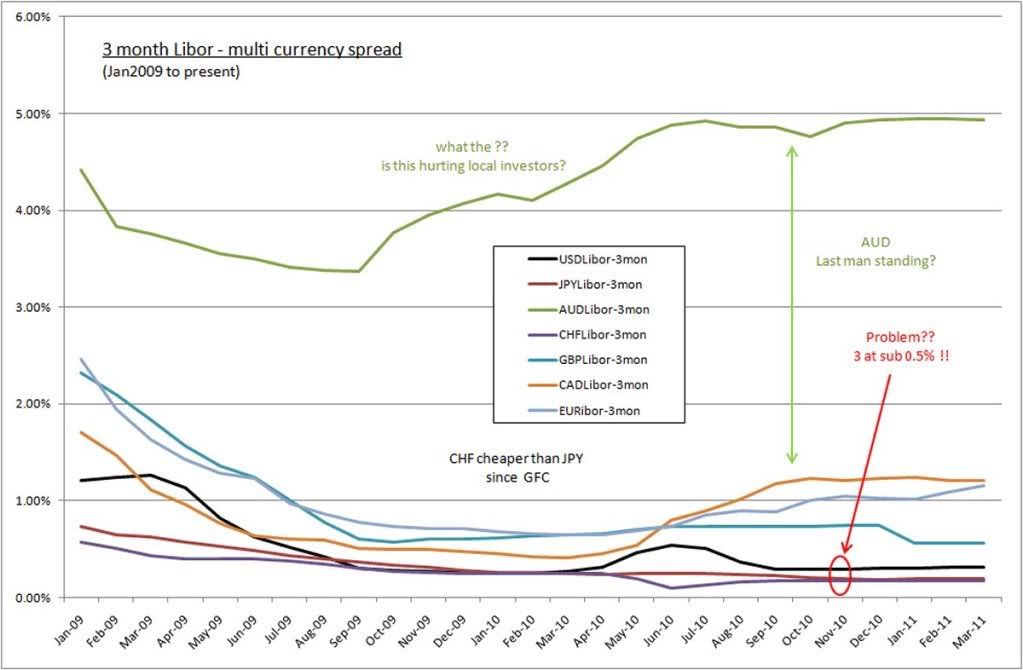

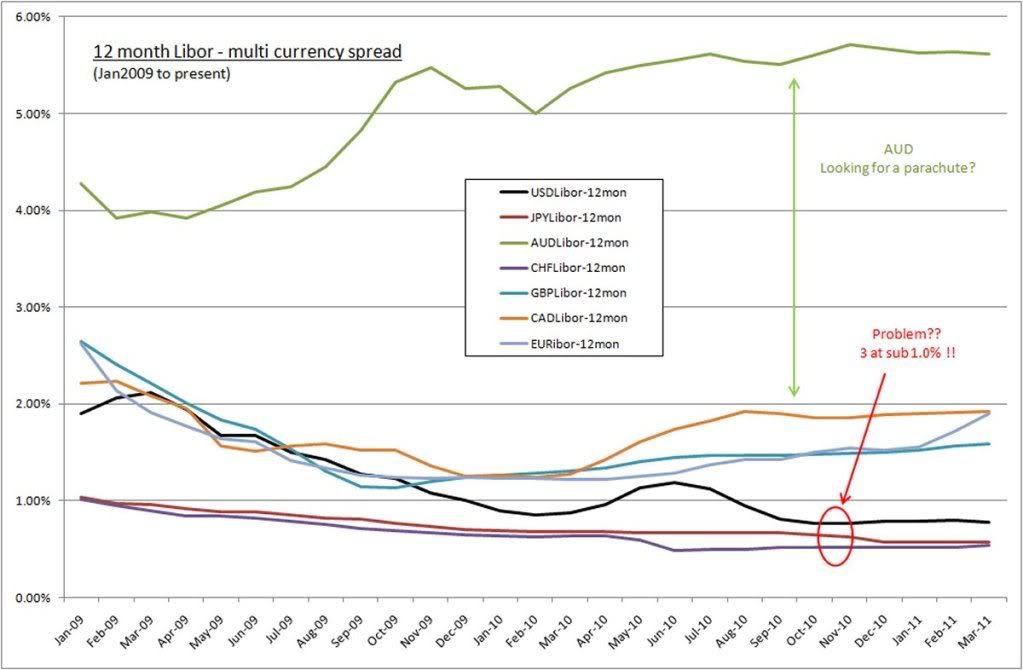

1. A surprise - the cheapest lending is currently via CHF, a healthy 15% on ave cheaper to borrow in CHF than YEN across all terms out to 12months. Are the Swiss desperate to generate activity??? This low Libor generates interest in making the CHF stronger in demand over the USD. Likewise for the Yen.

2. This is concerning, given these low rates of lending can amount to increased demand for CHF and YEN - so this is the hypocrisy if the SNB and BOJ worried about the demand (strength) for their currencies, why don't they set/raise lending rates???This will decrease demand for those pairs - typically raising interest rates raises demand for pairs indicating improved investment opportunities. But why not just raise lending rates? Likely to be because they cannot afford to dampen reduced demand - is this a normal market for this standard thinking to occur?

Looking at the broader Libor, a large problem festering is where is global investor growth going to come from in sufficient quantities to increase lending demand that raises these lending rates, and get lending rates back up to competitive levels across the board. What if low lending rates are caused by an excess of competition? Pre2008, it was only the Yen.

Central Banks are not interested in setting a minimum lending benchmark - letting primary bank lending demand set the rate instead. The charts below show how unsuccessful this has been to date.

3. Since Libors are a floating rate tool set by the primary lending banks, if there is no demand for lending (their majority revenue stream) they need to drop rates.

Likewise, they control the amount of lending by raising rates with the lending demand. If there is too much competition for lending, they are faced with a likewise scenario to compete with lower rates.

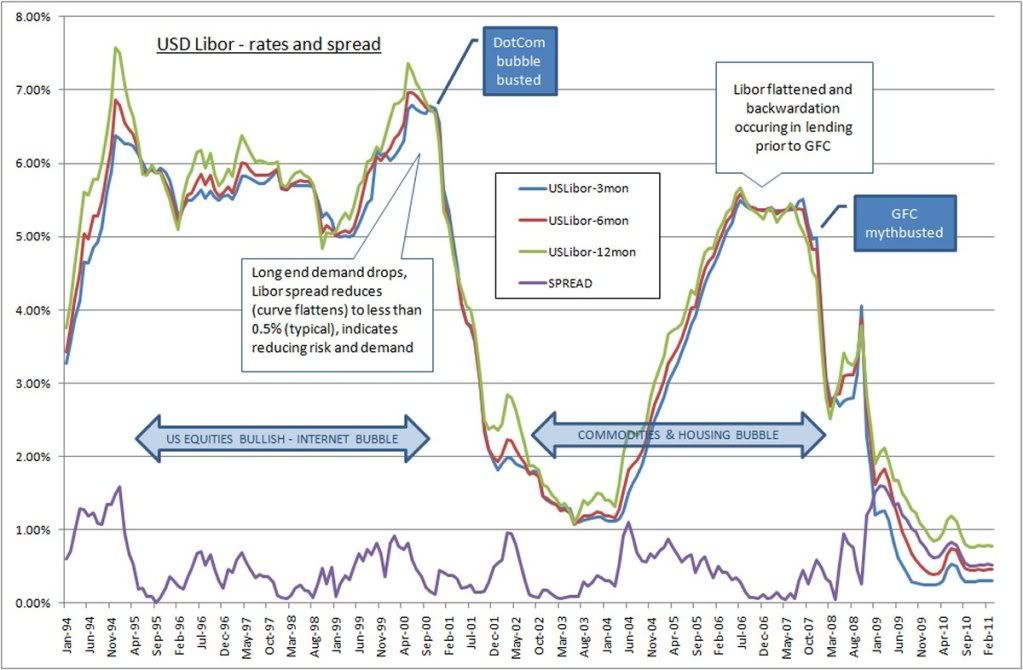

4. Low Libor rates currently indicate either (a) reduced demand for lending or (b) increased competition in investment lending. (a) results in slow to attract borrowing and lack of growth. If it is a lack of demand as a result of a lack of expectation/opportunity - then large investors could be sitting on the fence before committing more capital. This is a worry. But in conjunction with this, we have record high commodity prices???? It is counter intuitive, but raising lending rates might balance out the sense and sensibility of speculation. Unless there is an excess of lending creating too much competition that requires central banks to drop Libor to get some business. This would fuel speculation and drive commodities even higher.

5. There are 3 currencies with long term (12months) lending below 1%. These are CHF, YEN and USD - again the lack of a large demand being a probable reason for this need, against a backdrop of low expectation/opportunity for return. The risk does not favour the reward. But now with 3 major currencies at sub 1% lending, the risk is increased to create excessive competition - bebcoming a race to the bottom.

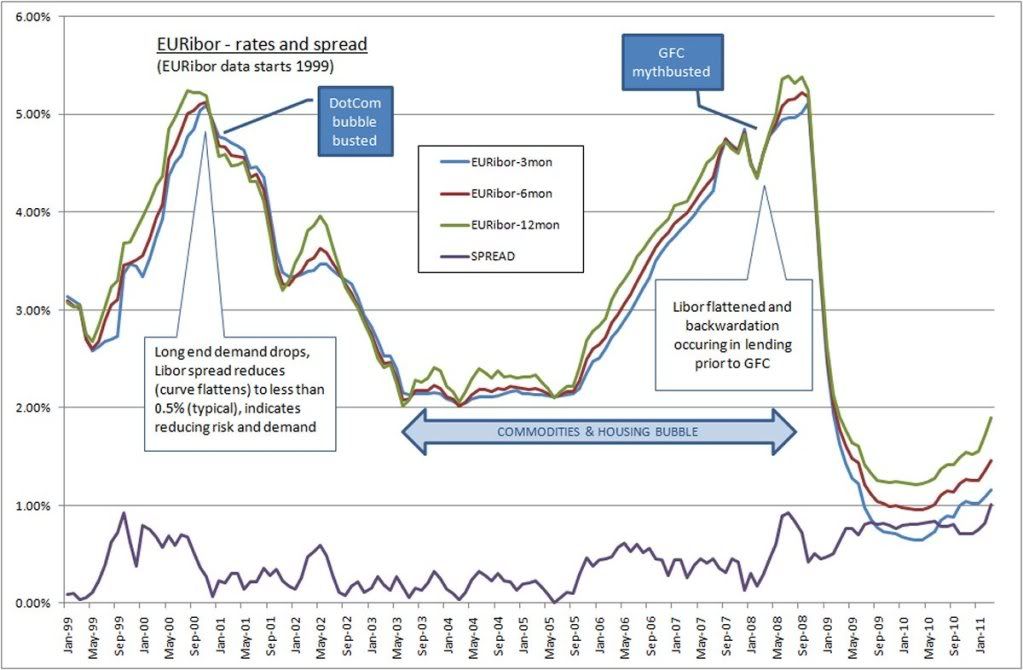

6. EUR, GBP and CAD are doing reasonably better to attract demand for lending at more nominal rates more indicative of growth and stability. The EUR remains in higher demand inspite of higher interest rates and lending rates than the USD and YEN. A clear indication that the EUR so far is more stable in generating real investment growth in preference to the lack of opportunity in the US. A trade surplus with a smaller budget deficit is no doubt an enormous advantage due only to Germany's excellent performance. The US has a massive trade deficit and deliberately expanded it's budget deficit. Good luck with that.

7. Australia is the single standout by 4 country miles. It is showing demand for lending nearer to 5%(3-4% higher than the majors) and the RBA is attempting to curb the overhang in local lending even still. You can imagine the bubble otherwise, with the accompanying inflation. This situation is compounded by cheaper foreign direct investment without a doubt.

8. Australia's interest rates would be representative of Brazil and China if they had similar available data. These economies are dealing with inflation due to increased demand and are needing to control it using interest rates to avoid problems. These centres like Euro and Canada (to a lesser extent) represent where real investment growth remains to any fundamental degree. But for how long?

9. The biggest problem I see is with cheap cross border foreign investment using USD, YEN and CHF. Access to these facilities would have to choke out local investors from their own markets. Something I believe we are seeing in Australia and the reason the RBA is keeping interest rates higher - unfortunately this is not helping local investors. If low Libor is due to an excess of competition, then global markets are overcapitalised due to a lack of opporutnity, and too much idle capital. This is an inflationary knifeedge if it's the case.

10. In terms of the health of the turnaround since GFC, the structure of the Libor spreads for EUR, YEN and USD look healthy and orderly. The low levels of the YEN and USD remain a problem.

11. One consistent observation is the duration/risk/reward structure that is the Libor spread similar to bond yields. Longer durations incur higher risk and therefore cost more. Interesting is when you see Libor spreads contract, the demand for long duration lending contracts and the cost of borrowing falls. This falls in the same sequence treasury yields fall - longest first. The long end contracts, and you see a backwardation in lending rates - it is more expensive to borrow shorter than longer. Signs of a likely trend change which leads a market turn.

12. Lastly, the competition between CHF/YEN/USD 'has to' impact the demand for the various currencies, and hence the broader currency markets. The fundamentals around having low Libor in the first place is concerning. But to have 3 of the world major currencies in the same situation is not reassuring at all. Purchasing power parity (PPP) is a means of determining exchange rates based on GDP growth and investment value opportunities. But these levels of lending are likely to skew fundamentals for some time. This is at the very core of currency manipulation.

To wrap it up - Zero interest lending does not encourage better risk assessment and improved investing conditions at all. It encourages speculation and reckless volatility by taking advantage of low volume markets with a reduced risk of loss. This is far more dangerous than it is healthy. A reason why we have record high commodities in amidst of low broader economic growth with record volatility. It is unlikely to me that we will see double digit broader rates of growth like what occured in 1996-2000 and 2005-2008. They were fabricated growth based on unsound underlying assets.

Watch for deliberate schyzophrenic volatility being sold under the cover of civil war or natural disaster responses. It is caused by cheap lending in the primary money market. Look for the growth within the stagnation, avoid those that are too big, too slow and too fat with too much debt and too little revenue.

2004 to 2008 made more billionaires than other other cumulative time in all prior history back to before the Egyptions. The competitive rates on the CHF/YEN/USD cannot be a good thing. The longer it lasts, the worse things will be.

Finally! The charts that started it all ....

USD Libor from 1994 to 2011 - note sub 1% interest up to 12month Libor

JPYen Libor from 1994 to 2011 - note sub 1% interest since 1995

EURibor from 1999 to 2011 - a more normal response to supply/demand/growth

3 month Libor multicurrency spread 2009 to 2011

The AUD is on it's own, the CHF/YEN/USD are in a race to the bottom

12 month Libor multicurrency spread 2009 to 2011

The AUD is on it's own, the CHF/YEN/USD are in a race to the bottom

As I see it, Libor is close to ground zero for the whole financial system. The root for the fruit as they say. Nothing I read about the US budget deficits in conjunction with the 3 lowest Libor rates being where they are makes me warm and fuzzy.

I miss that feeling - ignorance was bliss(;o) We need another bubble. Any thoughts?

As for currencies, they will pick apart all and any weekness in the EUR, China and AUD - that's all they have left. Emerging markets have done well to weather the flood of foreign investment. What Brazil did was magnificent self protection (an investment tax). The repatriation into Yen took 3 months after Kobe, so we are yet to really see a Yen flow of funds with any earnest. You don't move 1000pips in 3 days (UJ and AJ) in fundamentally sound markets.

US borrowing at US libor will sell down the USD buying anything offshore USA so that will counter any move they have in lifting the USD. Only good for US equities as I see it, so a weaker USD is virtually a given. This helps their pathetic balance of trade anyways.Just trying to pick the threads amongst the sea of ignorant commentators. No-one seems interested in the Libor issue - odd seeing how fundamental it appears to a great many things.

The AUD lending rates are surreal by comparison. Not sure many realise the harmful effects this has for local AUS investors when offshore investors have such cheap source of finance. The RBA would not enjoy the position they have presently.Any shock to the AUD might be due to foreigners fleeing the country maybe. UJ and AJ was almost understandable for a day or so.A very good time to swing trade using basic patterns I think. This volatility might be around for a while.

No comments:

Post a Comment