This is a combined format analysis of the USDindex (US Dollar basket, USDi), that includes COT analysis for the index and 7 related currency pair components. This is a definitive consolidated examination of the USDindex that incorporates in depth daily and hourly trend analysis as well as COT assessment the underlying instruments. For a definition of the ICE exchange traded USDindex go here. As you will see, it takes some time to put together and is the result of more than 12 months of private research ... my summary is down the bottom.

Preamble: I use the USDindex (USDi) as one of several critical broader market indicators, and not just for currency trading. As well, I have developed 2 models using composite calculations based on 7 major pairs EU, UC, GU, UJ, AU, UCad, USek. As a result, the movement in the USDi explicitly requires corresponding movements mainly in EU, UC, GU, and UJ.

USDi Trend Summary - After the turbulence subsided from the recent March expiry (triple witching week 14-18Mar) - the June USDi contracts turned over with a +0.3c premium above March. The trend remains obviously down having broken below a 3 year support line back to Mar2008. It has no immediate support and is positioned slightly above midway in a strong down channel. The USDi trend has a recent habit of shocking various broader markets on trend breaks.

USDi daily chart - click to expand

USDi is currently threatening to break the recent down move. It is hardly going to race upwards quickly from this position unless a black swan occurs with a rush of panic in response to a new threat not previously known. RSI and Slow Stochs are turning up from touching overbought levels indicative of the recent support showing in the USDi, and are now showing bullish divergence since the November 2010 (higher) low at 75.6.

This looks to break the recent downward move, but has a long way to go to establishing a new longer term up trend which is above the 233 EMA around 79.0 at that time. Regaining the 3 year support line above 77.0 would be a concerning sign of growing USD interest and would put equities and commodities on notice. Technically, a turn up from here would not surprise (fundamentally it is a different matter).

(A comparison to the 1995 Kobe earthquake quarter is on a separate blog created a few weeks ago, but I am yet to publish. Will update this part when I do)

Daily USDi chart on stockcharts.com - here

USDi hourly chart - reduced due to data source of new June2011 contract

Targets - I remain overall bearish on the USdi but a sharp rally might spook everyone so it's worth watching closely; nearest horizontal support below at 74.3, with the previous historical low of 71.0 below it (a technical low of 61 is actually possible, but unlikely. Below 71 isn't). Reclaiming the 3 year upward trendline above 77 would negate this tantalising prospect. I'm favouring a failed H&S target of 72.0.

USDi COT data 22Mar2011 - here to view USDi COT chart

Open interest increased marginally (1,769 or 3.4%) to 53,140 (76.3% of previous peak 69,674 in Feb2010). The USDi is dominated by speculators, moreso the Large Speculators holding 66.2% of all positions. All new trades were added by speculators - mainly Large Specs adding longs matched by new Small spec shorts. Large Specs continue to disagree with Small Specs, however Small specs are now evenly undecided. Net positions narrowed marginally but are still historically closer to zero (<30% of range, not extreme). Importantly, Commercial reduced both long and short positions overall by 4.4% and are now only 22.9% of the USDi trading, being themselves 3.5:1 nett long. Large Specs are themselves 1.5:1 short, while Small Specs are almost evenly split net zero (short 5,710, long 5,716). All this indicates increased uncertainty and likely increased volatility ahead with weak support for the USDi. The Small Specs are fence sitting amongst the current uncertainty. Indicative of the chart trends above, the USDi is lacking support of any kind - especially support for a change in trend. This is likely to change if Commercials begin to increase their interests one way or the other. Large Specs will position themselves opposite Commercials when they do - closing out the losing side of any trend change. Sentiment sits with Large Specs until then - being short and down.

________________________________________

THE COMPOSITE MAJOR PAIRS

There are 2 models I use for the USDindex. As a result of bifurcation, the 4 pair model differs from the 7 pair model but both result in good approximate trend for the USDi. According to my estimations, construction of the USDindex from the major pairs is roughly as follows - EURO 35%, CHF 35%, GBP 15%, JPY 10%, others 5% using the 4 pair model. The 7 pair model is recently new and throws up some interesting contrary assessments that I am yet to fully correlate into firmer understanding.

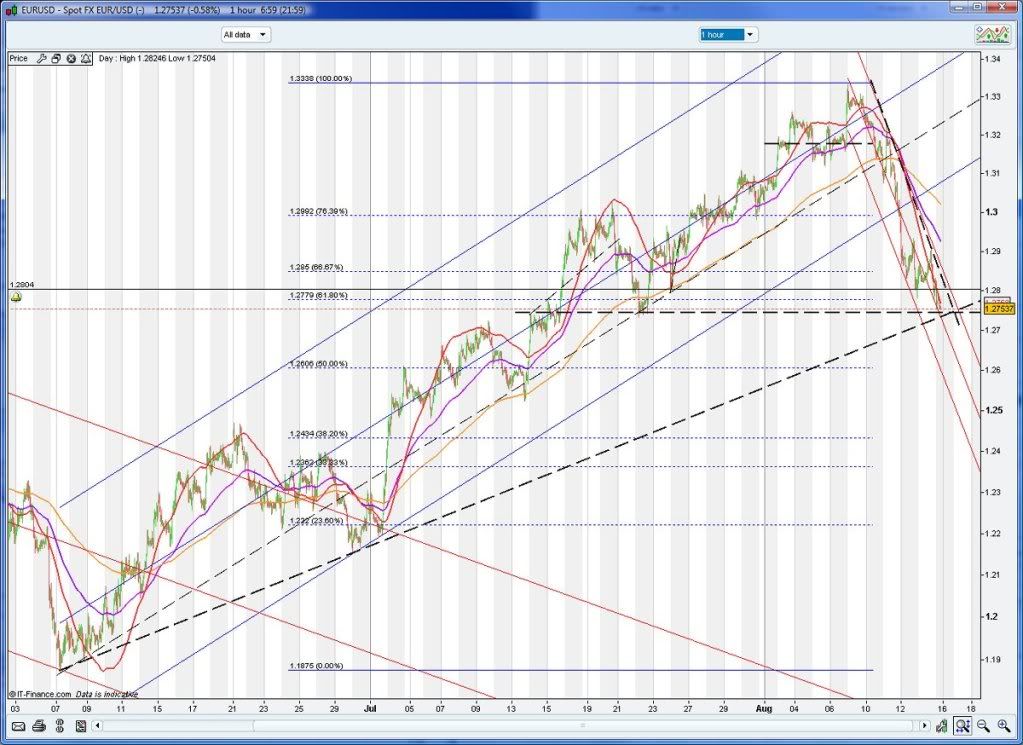

EURUSD (EU) - the EU carries a major influence within USDi analysis, more than any other single pair. I have no position currently, but for me long is expected to continue (based on accepting the above downtrend continuation in the USDi). Broadly the EU is currently in a strong upward trend in an overall long term down trend. Rising wedge forming in the right hand edge of a cup formation. If support holds above 1.386, and 1.434 is breached, I then expect somewhere up towards 1.50 to be a target for a reversal. Currently sitting at midpoint of a rising channel bracketing this rally. There is overhead downtrend resistance at 1.434. RSI is trending just below overbought levels, with the Stochastic overbought for nearly 3 weeks now. We are in reversal territory, but it might be too early.

EURUSD daily chart - click to expand

EURUSD 1hour chart -

EU 1hour pushing into the top edge of the rising wedge, strong -ve divergences appear in both RSI and Stochs, however the 1hour appears to be becoming oversold. It's hard to imagine precipitous falls in the EU from here. Upwards for me if 1.40 holds.

Targets - bearish for EU is a lower support around 1.386. Bullish target is 1.50, with 1.45 minimum on a breakout of 1.434.

EURO FX COT data 22Mar2011 - here to view EURO FX COT chart

NOTE: EUR COT data indicates the same as the EU trend, being the interest in the EUR component only

Open interest increased moderately (11,814 or 5.2%) to 240,256 (55.7% of previous peak 431,261 in May2010). This rally has forced the closure of a very large short position held by the Large Speculators at the bottom in Jun2010 at 1.20. This week Large specs decreased both positions, reducing more shorts to now remain net long 3:1 (a switch to net long occuring in Jan2011). New trades this week were mostly new long positions by commercials, who remain net short 2:1. Overall net positions narrowed marginally sitting roughly 50% of peak range - with Large and Small specs being net long 2:1 overall. New Commercials positions this week were long 2:1, increasing their participation to 42.4% of EU FX trading (remaining nett short). The biggest single change was new long positions by Commercials. This confirms a continuing trend in the EU. Comparison to the EU rally in 2009 indicates in increased likelihood of upwards. Small speculators have reduced longs and opened shorts to remain long by the smallest margin. So are likewise spooked by current affairs. EU fx is marginally overweight to speculators.

While I don't understand the 3month EURODOLLAR - assuming it is a 3month futures type instrument, the Commercials are the major stakeholder (68.4% of this market) and are fractionally nett short. Large Specs are 2:1 long on 6.5% of market with a large 17% spread position. Small specs are fractionally net short on 24% of this market. All indicating a swing either way is likely. Worth watching if this trend is the future.

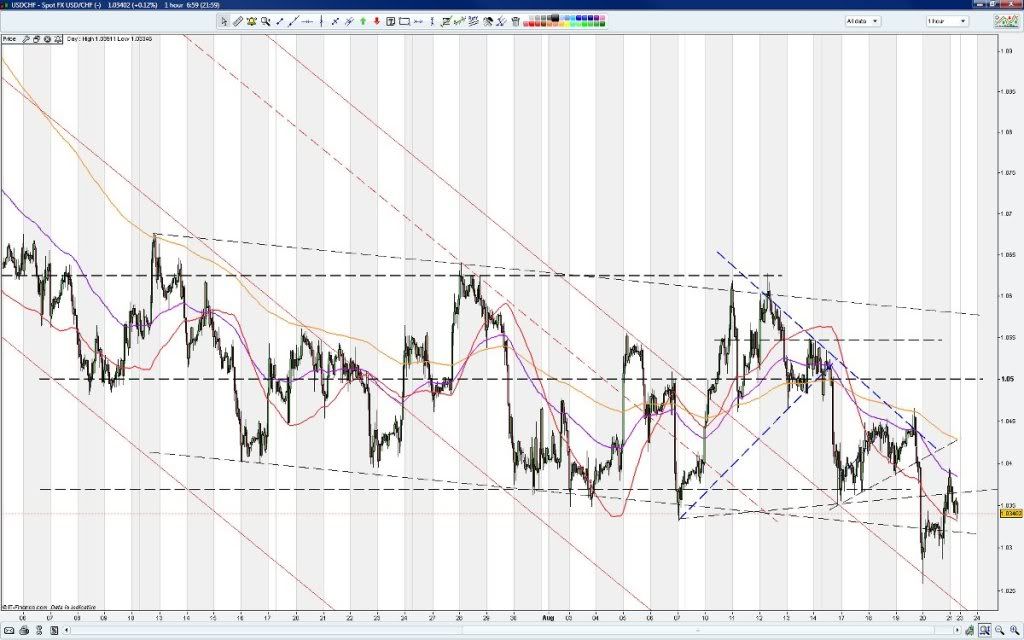

USDCHF (UC)

The UC is firmly in a multi year long term down trend (now in it's 10th year) indicating the continued strength of the CHF over increasing USD weakness. Have traded the UC on and off since 1.05 with reasonable success, but having learned a few things incorporating COT data has helped me trade the volatility in the UC.

For the USDi to go lower then UC would need to at least hold, or go even lower on a rising EU. On the daily UC, a low of 0.847 is not unexpected which would allow this. Current UC charts indicate it might be testing the upper edge of the trend channel/falling wedge. Short term bullish.

If the UC rises, it cancels any effect of a rising EU and the result is USDi holds steady. I suspect UC up with EU possibly slightly weaker in the short term. Strength in the USD has to come from failing CHF and failing EUR.

USDCHF daily chart - click to expand

Alternative USDCHF daily chart with clearer short term patterns here

USDCHF 1hour chart

- flag breakout and channel breakout in the UC (a weaker CHF) occurred in Friday nights trading

Bottom of long term falling channel at 0.847 is support. Above 0.94 (daily) would be a new up trend break of current down channel / falling wedge. Daily remains in a falling wedge in a bullish case.

CHF COT data 22Mar2011 - here to view CHF COT chart

NOTE: CHF COT data indicates the inverse of the UC trend, being the interest in the CHF component only

Open interest decreased moderately (-3,828 or -6%) to 59,701 (35% of previous peak 157,623 in Jun2007). The largest single change coming from Large Specs closing longs (but remaining 8:1 long CHF) matched by Commercials closing shorts (getting burnt!). This is profit taking by Large Speculators (or cutting losses by Commercials). Large and Small Specs hold 58.3% of total participation (with both nett long) , covering Commercials who are 8.5:1 nett short the CHF (expecting a USD recovery?). Net positions narrowing marginally and were historically quite extended(>90% of peak range). Large Specs reduced participation last week closing out 21% of previous positions (a large % change making Large Spec the smallest group now trading CHF). There is healthy support for continuation of trend - but closing positions (falling OI) could spell a trend change. Comparison to Nov2004 indicates an increased likelihood of a trend change in the near future. Commercial interest is 41.7% of this market. Small speculators remain 2.5:1 long CHF. Falling wedge in UC to watch for a convincing break, otherwise the trend remains down for the UC on the above.

GBPUSD (GU)

I do not trade the GU, as I do not keep up with news in the UK unless it is global. It is interesting that the GBP has held it;s own against the USD given one has austerity, and the other is freebasing on numerical increments of loose monetary policies. Maybe an indication of common sense prevailing? (one can only hope)

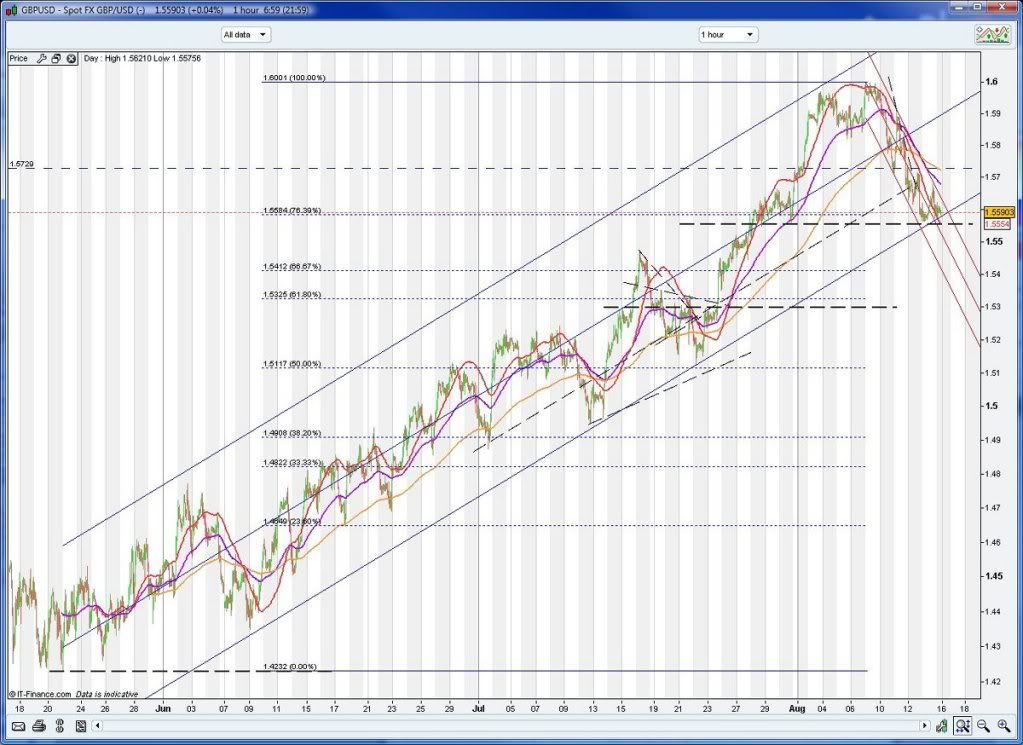

GBPUSD daily chart - click to expand

GBPUSD 1hour chart -

Targets - Expanding range (hourly) inside an ascending triangle (daily). Support would be 1.583 from the daily in a short term bearish case. If the hourly support at 1.598 holds and the GBP targets towards 1.66 first (upper channel edge), it might suggest the reversal point for continuing down the trend channel.

GBP COT data 22Mar2011 - here to view CHF COT chart

NOTE: GBPCOT data indicates the same as the GU trend, being the interest in the GBP component only

A large increased in open interest by almost 20% (20,810 or 19.6%) to 126,884 (69% of previous peak 182,707 in May2007). This follows a large decrease in positions over the previous month. All groups increased positions this week, the largest increase by share going to Large Specs with a 34.8% increase in positions (all long, closed some shorts). The largest single change coming from Commercials adding shorts and closing out longs to increase to 2.3:1 short. Large and Small Specs control 54.4% of GBP trading, and are both roughly 2:1 long. There appears to be plenty of headroom in all caps, so I would side with the Spec traders in the short term.

USDJPY (UJ)

I love trading the AJ and UJ. Japan has a lot going on lately. It was attracting the wrong kinds of attention for justifiable reasons on paper earlier in the year ... and yet it has maintained a strengthening trend against the USD. This is a comon theme for many pairs - multi year strength against the eurphoric optimism peddled for the USD. Anyhow, sticking to the facts ...

Looking at Kobe market responses against many broad data streams, repatriation into Yen took several months. We are bigger, longer, and more indebted 15 years later, so perhaps a similar trend is yet to develop. The recent 1000 (+/- 500) pip roller coaster was rife speculation to me - pure and simple. I was short UJ in time, but foollishly though it would sustain the move. Even so, I managed to capture half the short profits before speculation intervened.

USDJPY daily chart - click to expand

USDJPY 1hour chart - looking a treat! Easy-peasy ....

(I'd brag about the beautiful short trade, but hadn't counted on the schizophrenic speculation!)

I still see the UJ chart trend as unlikely to be strength into the USD as repatriation was observable post Kobe - and I suggest the same this time around. Moreso since the Japanese Gov't has made commitments to reduce Gov't infrastructure spending in order to control public works expenditures. The Sendai earthquake is likely to undo this decision, however funds might come to the aid of the required restructure. The UJ pair has around 10% input into the value of the USDindex. This trend is less important for the purpose of the USD direction.

The recent volatility in the UJ is more reminiscent of the May2010 Flashcrash. In spite of the extended zero interest lending within the Yen since 1996, the Yen has continued to strengthen against the USD. Will be interesting if/when this long term trend ever changes - as with several other major pairs.

JPY COT data 22Mar2011 - here to view JPY COT chart

NOTE: JPY COT data indicates the inverse of the UJ trend, being the interest in the JPY component only

Open interest decreased marginally (-2,412 or -1.8%) to 131,550 (33% of previous peak 393,428 in Feb2007). The decrease was caused by a closing of both speculator group positions, Small Specs closing out 14.2% of their positions - an amount almost 2:1 over Large Specs, and mostly short positions (this would be losses). This results in Large and Small Specs in disagreement. Large Spes are 2.7:1 nett long Yen, Small Specs are only fractionally net short. Commercials increased their positions by 9.1% (to 43.2% of positions held) with adding mostly shorts, leaving the 2 spec groups control the remaining 56.8% of this market. Commercials are 1.8:1 nett short the Yen.

AUDUSD (AU) - the AU is close to home. I am now long currently, having correctly opened shorts at 1.18 last time at these levels, but failed to capitalise properly on the recent 200pip dip down to 0.972 thinking it was going lower (idiot!!). For me long is expected to continue for now to at least daily overhead resistance at 1.036. (based on accepting the above downtrend continuation in the USDi). Broadly the AU recovered strongly to a trend breakdown in what is now a volatile sideways trend. A rising wedge is forming in the right hand edge of a cup formation. If support holds above 1.02, and 1.036 is breached, I expect somewhere up towards 1.10 to be a target for a reversal. Currently highly volatile and a swing traders dream (which I am yet to master properly).

AUDUSD daily chart - click to expand

AUDUSD 1hour chart -

Targets - currently long AU, so am bullish until the rising wedge fails. AU lower support is around 1.018/1.02. Bullish target is overhead resistance around 1.037. If it breaches 1,037, then 1.04, then 1.052 the median line of the channel. If it gets that far I'll be happy.

AUD COT data 22Mar2011 - here to view AUD COT chart

NOTE: AUD COT data indicates the same as the AU trend, being the interest in the AUD component only

Open interest this week remains wholely unchanged (+0.2% increase) at 109,078 (69% of previous peak 158,839 in Apr2010) - but OI has dropped significantly in the previous 3 weeks. This week sees Small Specs closing 14% of their positions (evenly) to remain nett long 1.8:1. Large specs and Commercials both increased their positions, with the single largest change being Commercials adding virtually all new shorts. These new short positions by Commercials (extending net short out to 4.8:1) were covered mainly by Large Specs (extending net long out to 6.8:1). Large and Small specs are 54.1 of this market and are both net long overall. Commercials increased their participation to 45.9% of AUD trading (remaining nett short). This supports a continuing trend in the AU for now. Comparison to the AU rally in Jun2008 indicates an increased likelihood of a trend change. Small speculators have reduced longs and shorts to remain long overall.

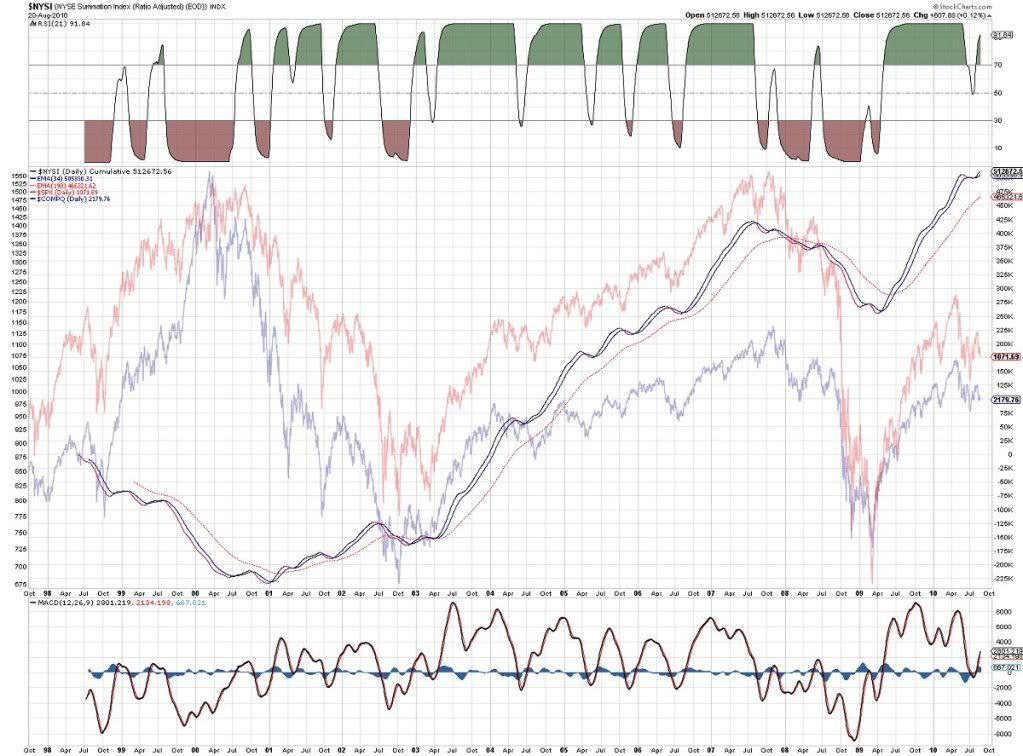

OVERALL SUMMARY

Current real issues are - Japan earthquake recovery and trade impacts, US trade and Government deficits, extended US housing/unemployment problems, PIIGS debt and trade burden for the EU, slow broader economic GDP growth, middle east unrest, financial regulations and the resulting level of speculation. The EUROzone has otherwise performed strongly thanks mainly to Germany against obvious and ongoing US economic weakness. A sustained low dollar policy is what the US would benefit the most from - hence why I doubt the US would be interested in intervening. It is the relative exchange strength of trading pairs that is hurting most outside the US.

Ignoring virtually everything in the news, the fundamentals of Germany's trading and recovery since GFC is exceptional. The larger monkey that is the remaining EUROzone debt problems coupled with what looks like capped growth opportunities is restraining an onslaught of EURO investment. But I think the EU will continue to strengthen overall among a background of otherwise ordinary opportunities.

Almost 12 months ago I thought there was an argument that private enterprise in unable to or (more likely) unwilling to commit large capital funding into asset prices due to weak consumer sentiment globally. I think some reluctance has overcome part of this issue, but it is yet to fully disappate.

The recent rallies in EU and GU since defy the proponents of global media calling for a recovery of the USD. This is despite impacts on trade from the commitment to cut back spending (austerity). There STILL remains no strength returning to the USD. Broadly lower open interests suggest everyone is waiting for decisive news to break. Since Aug2010 gold has increased in value 10%, and the USDi has dropped 9.2%.

We have clearly seen aspects of stagflation/deflation in spite of the new QE2 being tabled by the US. At best it remains a transitional market at the moment historically low Libors in CHF, YEN and USD providing cheap lending to those with access. The news for the EU is still generally more reasonable than that for the US - both have serious debt problems to overcome. The difference being that the EU has Germany as a powerhouse. Are Germany's opportunities reaching their limits?

I am suggesting at this point in time that this fall in the USD will continue on a weak bias to US economics over strength bias to EU.

Time will tell how decisive the next week moves in the USD are across various pairs. 77.0 is now overhead resistance and might be a ceiling for the USDi for a while until signs of real growth appear from somewhere. More volatility in trading is virtually assured with such low levels of lending available across various currencies.regards to all, and safe trading

LH

Disclaimer: These are my personal opinions only. Any viewing or use of information provided by me is done so entirely at your own risk. I go to extensive efforts to ensure data available to me is up to date and accurate. I will not accept any liability for loss or damage arising from the above inclusive of errors, omissions or just plain ignorance. Trading can result in significant financial losses.