(now in combined format)

The USDi continued its upward breakout of the down channel to a new recent high of 83.30 and now sits above all daily EMA's. On Wed evening it tagged the 61.8%Fib retracement (of the recent breakout leg up) at 82.0 which is significant to me, as this was also the 200EMA on the daily. At the very least - unless the next move up fails at 83.40 (unlikely, but it is a daily resistance line) - this might be an ABC up correction (similar now to the EU movement down, shown below) within a larger overall down trend of the USDi. I suspect then this week will see more minor damage to the equity markets with the USDi target for C upleg being at least the length of A - which is a minimum of 85.1 for the USDi within the week.

The issue becomes - is this simply a USDi/EURO correction, or is something more problematic brewing? There is still the gap left at 81.0 which might provide a clue, as one day it will be filled. Currently the USDi trend is firmly upwards having now been confirmed by continuation through 82.80.

Presently, failure below 82.5 would restore buying into equities as the USDi trend has broken down. The USDi broke through the 61.8% Fib of the recent 2010 bull run at 83.20. A failure here remains bearish with a break now below 82.0 being below the daily EMA's again - but this is not likely now, daily indicators showing upwards with the USDi.

(USDi daily chart) - clickable

The daily indicators RSI (breaking 50) and Stoch (above 0) suggest this rally will continue (is not overbought on either), so concern is real for equities with USDi moving into the danger zone with the USDi now above all daily EMA's.

Daily USDi chart on stockcharts.com - click here

(USDi hourly chart - updated retaining previous trend lines)

Targets - 85.1 minimum; not sure if divergent tops in the RSI and Stoch's on rising USDi will show. Projected Fib indicated as an estimate. Daily MACD is below zero still, indicating this might just be an ABC correction only. Winks/WnL might comment on this?

THE COMPOSITE MAJOR PAIRS

According to my estimations, construction of the USDindex from the major pairs is roughly as follows - EURO 35%, CHF 35%, GBP 15%, JPY 10%, others 5%

EURUSD - now short for next week, in an ABC down

In reference to some EWave goings on regarding a possible ABC wave down (appendix below), an alternative to my previous update (thinking it was entering wave 4) - last week might have just seen B corrective up wave (in ABC down), which would mean C wave is yet to complete. Since C = A as a minimum EU has more downleg to come. Even if this is now a 5 waves down movement (1,2 just completed), then the EU will go below this projected level as C is not the shortest wave.

At this stage I'll go with ABC leg down - EU is now in C leg.

EU 1hour chart

As noted last week, I didn't fall in love with the rally in the EU from last weeks low as it bounced off 1.273 on Monday morning. Staying short EU now would be the trade IMO. This strengthens the USDi in an opposite ABC upwards. If correct then, does this establish that leg A down finished equal with leg 4 - being the double bottom noted last week?

Targets - thinking only bearish for EU in a C leg down (assuming it is C)

C target = 1.234 (min), 1.198 (max) (in any case of either 5waves or ABC)

(now looking at this as a complete 5 waves to 1.333)

1.261 is the 50% Fib retracement of the recent 5 waves up, would be a shorter target

1.222 is the 23.6% Fib of the recent 5 waves up

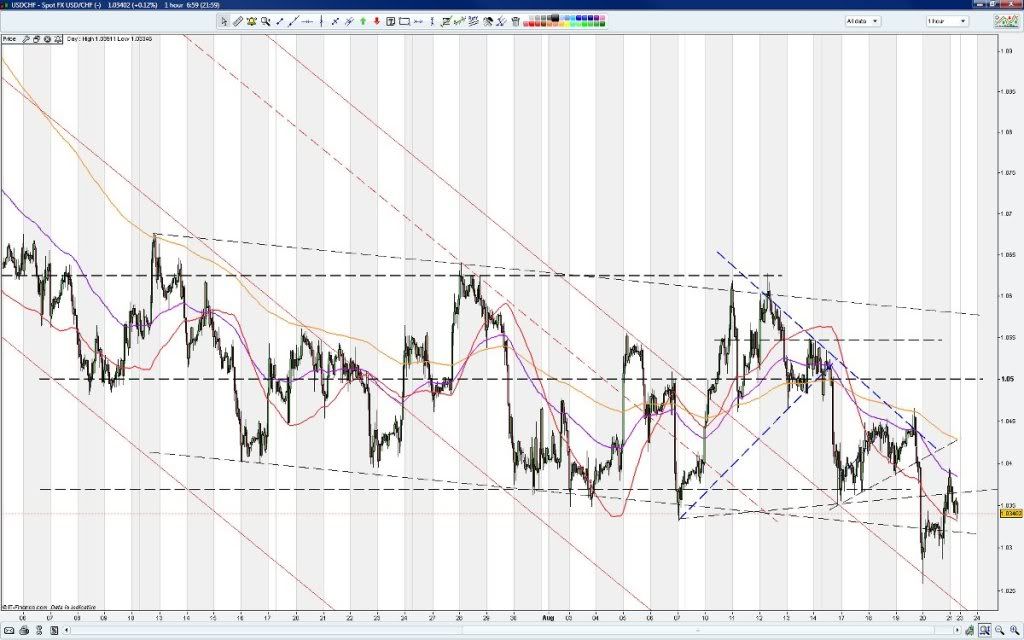

USDCHF

The UC is in no mans land after it broke down below 1.037 to 1.027 - which puts it nowhere. It should continue sideways for the week in a new range within a high of 1.04 and a low of 1.02.

I continue to assume the UC is setting up the pattern for underwriting the direction of the USDi - which is further down (CHF getting stronger) in my opinion. But for the USDi to go lower after the current ABC corrective wave up then UC would need to at least hold, or go even lower on a rising EU. On the daily UC, a low of 1.012 is not unexpected which would allow this.

If the UC rises, it will cancel any effect of the EU rising and the result is USDi will hold steady. This will then show us if the equities are following the EU trend or the USDi proper. More time is needed to reveal this, but I suspect UC up with EU up giving a sideways USDi.

If the UC returns up and while the EU weakens further, the USDi will move up rapidly resulting in an equally sharp drop in equities and commodity prices. If the reason for this rise is fear, gold will rise with the USDi.

UC 1hour chart

- more weakness in the UC (a stronger CHF)

1.04 is now resistance; support is at 1.0225 or lower at 1.012

GBPUSD

The GU range traded all last week, with weak a bearish trend. It broke sideways from the uptrend channel - and might now be in a similar ABC down correction with the EU.

A breakdown might be confirmed early in the week, with the trend sideways. It sits on the bottom edge of the channel presently.

GU 1hour chart - a collision of 2 channels resulting in failing up trend

Targets -

If correct with a recent 5 waves up, leg 4 finished at 1.511, which would be a 50% Fib retracement support for the GU. GU failed to get above 1.573 after a small rally to 1.569 - just short of the 1.57 target last week.

Now clearly bearish - lower Fib retracements on the GU chart are the 61.8% Fib (1.532), which won't be breached easily, so am expecting a bounce from this level. Below this is the 50% Fib at 1.511 which shoud hold based on an ABC correction in the GU, if this is correct.

USDJPY

UJ 1hour chart - remains within a trading band. The UJ is a combination of strong downward channel and falling wedge. Each time resulting in a lower swing bottom. Is it bottoming this time? Still .... what does it mean? The Yen is getting stronger still - this is not helping Japan's current economic problems and is likely to weaken in the short term.

The UJ neckline setup at 86.37 with a support below at 85.56 failed and the UJ is range trading sideways with no decisive up or down direction at all (consolidation). 86.37 remains as an upper bound, with 85 below it. This could be Japan electing to weaken the Yen - if demand remains for the Yen (strengthening it), it confirms to me its role as a primary trading currency in high demand.

I still see the UJ chart trend as unlikely to be strength in the USD - as the daily shows that 84.0 is likely (as weakness in the USD). The UJ pair has around 10% input into the value of the USDindex. This trend is less important for the purpose of the USD direction.

A SUMMARY -

There remains plausible explanations for the ongoing weakness in the EU and GU based on impacts on trade from the commitment to cut back spending (austerity). Is strength returning to the USD? Still no real strength to speak of in the USD. It's now a bit more than simply profit taking (in the EU and GU) and economic fear might be building - but for stagflation/deflation reasons.

It is like there is no alternative activity and everything above is showing signs of disinterest - waiting for decisive news to break. Monday I think will be quiet all round until the news on the EUR trade figures. UC and UJ are not doing anything remarkable to show underlying strength in the USD. Gold prices have sustained on the rising USD which is an indication to me more of fear in the markets.

Movement down in the EU and GU is not accompanied by any real move in the UC and UJ. Hence the EU and GU so far are the only cause for the rise in the USDi. This theme should continue next week with the moves indicated above (if I am reading it correctly).

Fear might be taking hold however stagflation/deflation remains the only reality unless a new QE2 is tabled. At best its a transitional currently market it the moment with no clear direction to speak of. The news for the EU and GU pairs is still more reasonable than that for the US.

I am suggesting at this point in time that this rally in the USD will continue up on weakening EU and GU - breaking above 83.5 - meaning equities would likely dip. The main danger remains as continued weakening of the EU and GU at this point in time.

Time will tell how decisive these moves are. Maybe 80cents is the floor on the USDi for a while until signs of growth appear from somewhere. This results in more choppy side trading to come.rgds,

pw

APPENDIX - EWave assumptions on corrective (ABC) waves are as follows.-

Wave A (Has five sub waves 1, 2, 3, 4, 5)

Wave B (Has three sub waves namely wave A, B and C)

Wave C (Has five sub waves 1, 2, 3, 4, 5)

Corrective cycle may see all levels which are seen already up to wave 4 previously

Correction ends just above the level of wave 4. (but not always?)

Correction occurs in three waves, A, B and C - C wave's length is the same as A wave at least or 1.618 times A wave.

No comments:

Post a Comment